Items You Need When Applying For a Loan

Have These Items Ready When You Apply For a Loan It used to be that lenders mailed out verifications to employers, banks, mortgage companies, and so on, in order to verify the data supplied by borrowers. Nowadays, the interest is often in speed and getting answers quickly so alternate documentation

Read More

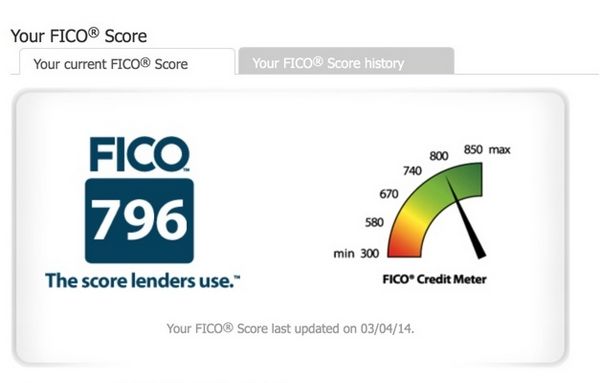

WHAT'S A FICO®?

What is a FICO® Score? FICO® stands for Fair Isaac & Company and is the name for the most well known credit scoring system, used by Experian. The credit bureau’s computer evaluates a complete credit profile and assigns a score, which is used to estimate credit worthiness. Each of the three bureaus

Read More

Categories

Recent Posts

Unlock the Potential: A Hidden Gem in Winter Garden's Bay Street Park Neighborhood

HOME SELLERS, HERE’S WHAT THE NAR SETTLEMENT MEANS FOR YOU

Homebuyers, HERE’s WHAT THE NAR SETTLEMENT MEANS FOR YOU

Questions to Ask a Real Estate Agent Before Hiring One

Why Neutral Colors Might Be Your Best Decision When Selling Your Home

Your Savings and Down Payment

Where Does the Money Come From for Mortgage Loans?

Lead Poisoning

Is Buying a Home Still a Smart Plan

Unlocking Solar Potential: A Guide to Remote Quotes for Home Installation